Discover if BBAI stock is a smart, high-risk investment for your portfolio. Explore expert insights, risks, and potential returns in this detailed guide.

BBAI Stock: A High-Risk Investment Worth Considering?

When it comes to investing, every portfolio has room for some daring picks. One of the hottest—and riskiest—stocks catching investor attention right now is BigBear.ai Holdings Inc. (BBAI). But should you really risk your hard-earned money on it? Let’s break it down.

Understanding BBAI: What Does the Company Do?

BigBear.ai is a technology company focused on artificial intelligence-driven analytics and decision-making platforms. Their services aim to help both government and commercial clients process large volumes of data for smarter insights. As artificial intelligence continues to transform industries, companies like BBAI are positioning themselves at the forefront of this digital revolution.

But with great ambition comes great uncertainty.

The Wild Ride of BBAI’s Stock Performance

Like many emerging tech stocks, BBAI has shown extreme volatility. Since its public listing, it has experienced rapid price swings, catching the eye of risk-tolerant investors looking for quick gains—or steep losses.

Some days, the stock surged on positive earnings or government contract wins. Other times, it plummeted following broader market corrections or concerns about the company’s financial health.

If you’re the type who checks their portfolio multiple times a day, BBAI will definitely keep your adrenaline pumping.

Key Reasons Investors Are Watching BBAI

📈 1. AI Sector Growth

Artificial intelligence isn’t a passing trend; it’s reshaping industries from defense to healthcare. BBAI’s focus on AI-powered solutions aligns with this growing demand, making it a stock to watch.

💼 2. Government Contracts

BBAI has secured multiple contracts with U.S. defense and intelligence agencies. These government deals provide some revenue stability in an otherwise uncertain market.

🔬 3. Emerging Player Status

As a relatively small company, BBAI has the potential for massive growth if it successfully scales its products and client base. However, small-cap status also means heightened risk.

The Risks You Can’t Ignore

While the upside potential is exciting, no investment comes without risks. Here’s what you should carefully consider before diving in:

⚠️ 1. Financial Instability

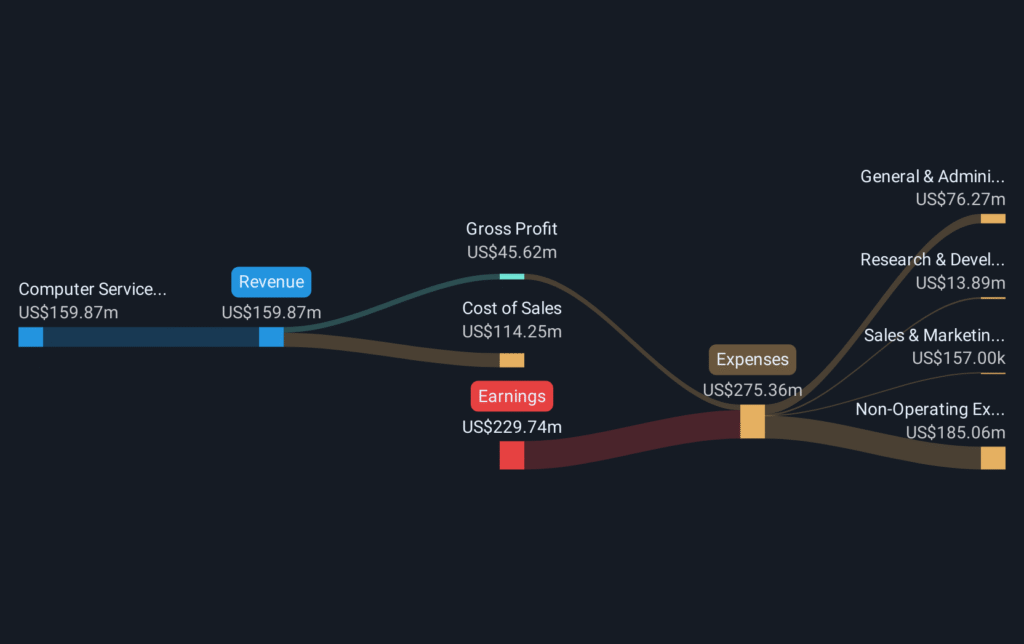

BBAI has struggled with profitability and debt management. Negative cash flow and dilution risks from future fundraising rounds could impact share value.

⚠️ 2. Market Volatility

Being in a high-growth, speculative sector subjects BBAI to broader market swings. Investors who can’t stomach sudden drops may find this stock too stressful.

⚠️ 3. Competitive Landscape

The AI space is fiercely competitive. Giants like Microsoft, Google, and Palantir dominate. For BBAI to carve out a lasting niche, it must consistently innovate and execute.

Is BBAI Stock Right for You?

So, should you invest in BBAI? Here’s a simple way to frame your decision:

- ✅ Yes, consider BBAI if:

You are a seasoned investor with a diversified portfolio and a small portion allocated for high-risk, high-reward opportunities.

You believe in the long-term growth of AI.

You can tolerate sharp ups and downs in stock value. - ❌ No, avoid BBAI if:

You’re risk-averse or new to investing.

You prefer stable, dividend-paying stocks.

You’ll lose sleep over market volatility.

Pro Tips for Managing High-Risk Stocks Like BBAI

✔️ Start Small: Don’t put all your eggs in one basket. Start with a small investment and scale only if your risk appetite allows.

✔️ Stay Informed: Keep an eye on company announcements, government contracts, and market trends in AI.

✔️ Set Exit Points: Decide your profit-taking and stop-loss points before investing.

✔️ Diversify: Balance BBAI with more stable investments like index funds, blue-chip stocks, or bonds.

The Bottom Line

BBAI stock offers the kind of thrill that some investors live for—a small company with big dreams in a booming industry. But with thrill comes turbulence.

If you’re prepared for a rollercoaster and understand the risks, BBAI could be worth a small spot in your portfolio. Just remember: no single stock should make or break your financial future.

✅ Suggested Internal Links for Your Website:

- [Top Artificial Intelligence Stocks to Watch in 2025]

- [How to Manage Portfolio Risk in Volatile Markets]

- [Tech Stocks vs. Value Stocks: Which Should You Choose?]

Disclaimer:

This blog is intended for informational and educational purposes only. The views expressed are personal opinions or general insights, not professional or legal advice. Readers should do their own research or consult relevant professionals before taking action based on this content.

#BBAIStock #HighRiskInvesting #TechStocks2025 #StockMarketTips #AIStocks #InvestmentOpportunities #RiskVsReward #StockMarketInsights #SmallCapStocks #FinancialFreedom #SmartInvesting #Carrerbook#Anslation#MarketVolatility #InvestorAlert #GrowthStocks #StockWatch

Leave a Reply